Customer Centricity

What we achieved

We strengthened our customer relationships during a year marked by macroeconomic uncertainty and acquisition related hesitancy. Our emphasis on delivering outcomes and value resonated with customers, allowing us to broaden our reach. Significant achievements include:

Expanding our market presence among existing customers while successfully diversifying into new segments.

More wins in Financial Services that highlight the effectiveness of our lab and test automation solutions.

Strategic growth in hyperscaler and enterprise customer segments, demonstrating the broad applicability of our offerings.

Our priorities

Continue driving our shift from selling product features to delivering outcome-based solutions.

Further diversify our customer base, reducing cyclicality and enhancing resilience.

Expand strategic partnerships to address customers’ pressing challenges, such as automation and efficiency goals.

Build on landmark deals to secure additional high-impact services opportunities.

Innovation for Growth

What we achieved

Our commitment to innovation positioned us for success. Key milestones included:

Launching our AI High-Speed Ethernet platform, the first of its kind, addressing critical data centre and AI networking challenges.

Introducing the PNT X platform, which solidified our leadership in positioning, navigation and timing (PNT) technologies across diverse sectors, including government and LEO satellites.

Maintaining leadership in Wi-Fi testing with enhanced solutions for Wi-Fi 7 and Test‑as‑a‑Service offerings.

Expanding our High-Speed Ethernet portfolio, including recognition for our 800G solutions and early adoption of 1.6 terabit testing capabilities.

Our priorities

Scale our service delivery capabilities and increase software content in our solutions.

Capitalise on opportunities in emerging markets such as AI-driven data centres and private 5G networks.

Maintain leadership in high-speed Ethernet innovation and expand into new verticals.

Deepen our investment in PNT technologies for automotive and aerospace applications.

Operational Excellence

What we achieved

We focused on ensuring operational resilience while maintaining critical investments. Highlights include:

Targeted cost-saving measures and real estate optimisation, supporting both efficiency and sustainability.

Organisational alignment to improve collaboration and streamline R&D oversight.

Our priorities

Continue to stay close to our customers and provide the necessary support as they develop and rollout their development plans.

Continue to invest and launch new products.

Safeguard our financial flexibility to navigate ongoing macroeconomic challenges.

Key performance indicators

Book to bill ratio*

Revenue

Adjusted operating profit*

Adjusted operating margin*

Adjusted basic earnings per share* (EPS)

Product development costs as a percentage of revenue

Voluntary employee turnover

Free cash flow*

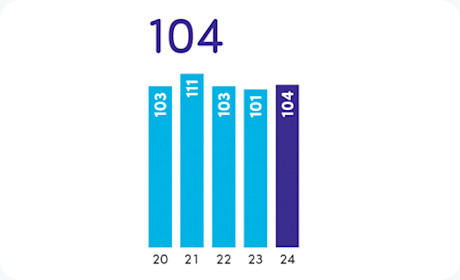

Order intake was greater than revenue in the year resulting in a book to bill ratio of 104 as we continue to win larger, longer-term contracts that improve revenue visibility and build repeatable business (2023 101).

Relevance to strategy

The book to bill ratio is an indicator of the underpin to future revenue and whether activity levels are rising or slowing, and therefore how effective we have been in the execution of our strategy.

Note: Items with * above are non-GAAP alternative performance measures, see pages 195 and 196 of the Spirent Communications plc Annual Report 2024 for more detail.